The Gift of a Lifetime Wealth Management Strategy

SSG Companies’ Gift of Lifetime Wealth Management Strategy Process

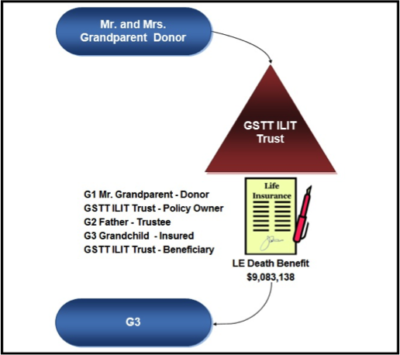

- The Grandparent Donors desire to provide their grandchild with a plan which will provide benefits for years to come

- The Grandparent Donors wish to utilize their annual gift exclusion in a manner that will provide lasting benefits to their grandchildren

- The grandparents will utilize the tax-free provisions of a specially designed life insurance contract to provide the benefits which will be discussed

A $28,000 annual gift for 10 years to the SSG Gift of Lifetime Wealth Management Strategy could potentially provide you with these benefits:

- The plan will be set up to provide for the educational expenses of the grandchild;

Pre-Tax Equivalent Tax-Free Benefit Income Tax Rate

$555,556 $400,000 28.00% - The plan will be set up to provide a retirement pension payout for the grandchild;

Pre-Tax Equivalent Tax-Free Benefit Income Tax Rate

$4,966,887 $3,000,000 39.60% - The plan will provide a substantial death benefit which can be utilized by the grandchild in their own planning;

Pre-Tax Equivalent Tax-Free Benefit Income Tax Rate

$15,038,308 $9,083,138 39.60% - The overall potential plan benefits provided for the grandchild in their lifetime may be significant;

Pre-Tax Equivalent Tax-Free Benefit

$20,560,751 $12,483,138

This will provide a gift giving opportunity that can last for the lifetime of the grandchild and can be a legacy asset, which will be kept and utilized throughout the lifetime of the grandchild.

In addition, these assets will be protected from liability claimants, creditors and adversarial ex-spouse due to the asset protection benefits provided in the life insurance policies in most states. In addition, the distributions from the policy are tax-free.